Singapore is set to significantly strengthen its regulatory landscape for corporate service providers (CSPs) with the upcoming commencement of the Corporate Service Providers Act 2024 (CSPA 2024) and its accompanying Corporate Service Providers Regulations (CSPR) 2025.

Both laws will take effect on June 9, 2025, reinforcing Singapore’s commitment to combating money laundering (ML), proliferation financing (PF), and terrorism financing (TF).

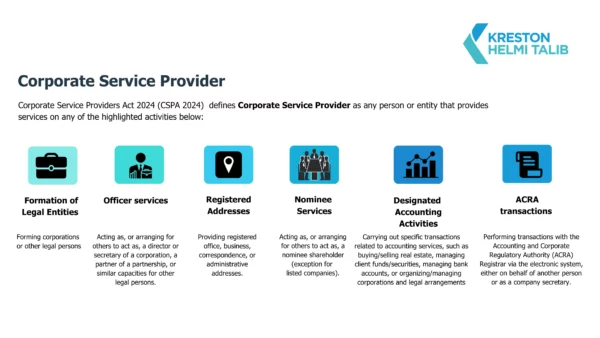

Who is a Corporate Service Provider?

The Act broadly defines a “corporate service provider” as any person in the business of providing a “corporate service.”

Key Roles: Registered CSPs and Qualified Individuals

The legislation establishes two primary regulated categories:

- Registered Corporate Service Providers (RCSPs) – These are the entities providing corporate services. Accounting entities (accounting corporations, firms, LLPs, or sole proprietors providing public accountancy services) are “deemed registered” RCSPs, acknowledging their existing regulatory oversight.

- Registered Qualified Individuals (RQIs) – These are individuals who either directly provide or supervise corporate services. Key appointment holders of deemed registered CSPs (e.g., sole proprietors, partners, directors, CEOs, or those principally responsible for corporate services management) are “deemed registered” RQIs.

The Registrar of Corporate Service Providers (appointed by the Minister under ACRA) is tasked with maintaining public registers of both RCSPs and RQIs.

Unified Legislative Against Financial Crime

The CSPA 2024 introduces a structured regulatory framework for persons carrying on a business of providing corporate services and the qualified individuals who provide or supervise these services. Its purpose is explicitly stated: to impose requirements on these persons to detect or prevent ML, PF, and TF. Meanwhile, the CSPR 2025 outlines the specifics of how this framework will be implemented.

Key Legislative changes are as follows:

- Require all business entities carrying on a business of providing corporate services in and from Singapore to register with ACRA as registered CSPs

- Require all registered CSPs to comply with obligations, including AML/CFT/PF obligations

- Introduce fines for breaches of AML/CFT/PF obligations by registered CSPs and their senior management

- Prohibit persons from acting as nominee directors by way of business unless the appointments are arranged by registered CSPs and they have been assessed as fit and proper by the registered CSPs

- Require nominee directors’ and nominee shareholders’ nominee status and the identities of their nominators to be disclosed to ACRA

- Increase fines pertaining to the register of registrable controllers, register of nominee directors, and register of nominee shareholders

Source: ACRA website ACRA CSP legislation

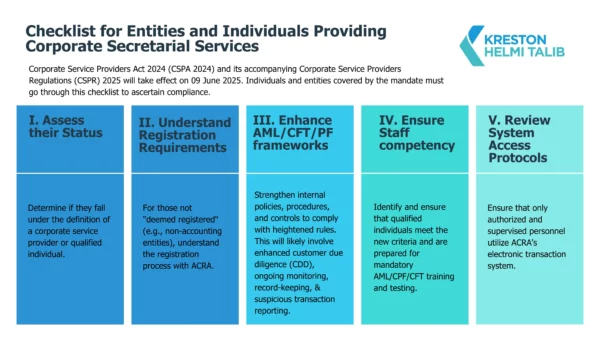

Implications for CSPs and Affected Individuals

Entities and individuals involved in providing services in Singapore must have thorough preparation for proper compliance. Below checklist can be a helpful guide.

The CSPA 2024 and its Regulations is a proactive measure to safeguard Singapore’s financial integrity. By establishing clear definitions, stringent requirements, and robust oversight, the new framework aims to create a more transparent and accountable corporate services sector, reducing opportunities for illicit exploitation. All affected parties are encouraged to review the full text of both the Act and Regulations and seek professional advice to ensure full compliance.

You may refer to the following resources for more details:

- Guidelines to CSP Regulations: Guidelines for registered CSPs

- FAQs: go.gov.sg/csp-act-faqs

All materials have been prepared for general information purposes only. The information presented in this article is not legal advice, and is not to be acted on as such, may not be current and is subject to change without notice. Professional advisory should be sought before taking or refraining from any action as a result of the contents in this document.