Ethics Pronouncement (EP) 100 Key Updates and Ethical Considerations

Singapore's Accountancy Body, the Institute of Singapore Chartered Accountants (ISCA), has released updates on Ethics Pronouncement (EP) 100 to incorporate revisions to the code. They are as follow:

- Revised EP 100 to incorporate IESBA's final pronouncement on Tax Planning and Related Services. This aims to reinforce the ethical responsibilities of professional accountants in Singapore when advising clients on tax matters.

- Revised EP 100 Implementation Guide (IG) 2 to provide clarity on Key Audit Partners (KAPs). Covering definitions, roles, and rotation rules of Key Audit Partners (KAPs) in an engagement, the guide is designed to provide professionals and businesses with a clearer grasp of the Code revisions aimed at strengthening independence and boosting audit quality, particularly for Public Interest Entities (PIEs).

I. Key Changes and Considerations on Tax Planning and Related Services EP 100 Revisions

The updated standard introduces a more rigorous framework for identifying and managing ethical risks in tax planning engagements. Below is a concise breakdown of the key considerations to note.

-

Ethical and Reputational Risk Assessment

EP 100 explicitly identifies four main threats that can arise from tax planning activities: self-interest, self-review, advocacy, and intimidation. The revised EP 100 places greater emphasis on professional skepticism and ethical judgment. Accountants must evaluate whether a tax plan aligns with the spirit and intent of the law, not merely its literal wording.

-

Broader Consequences Consideration

EP 100 requires the accountants to consider the reputational, commercial, and wider economic consequences of a tax plan. This goes beyond mere legality and includes potential adverse publicity, financial penalties, and the arrangement’s effect on the overall tax base of a jurisdiction.

-

Handling Uncertainty and Disagreement

EP 100 provides a clear process for dealing with uncertainty and disagreements. If a proposed plan is uncertain or lacks a credible basis, the accountant must discuss these issues with the client. If the client insists on a plan the accountant believes lacks a credible basis, the accountant must advise against it and may need to consider withdrawing from the engagement, as necessary.

-

Reasonable to Conclude Principle

Central to the new guidance is a threshold test: accountants must not be associated with any tax arrangement unless they can reasonably conclude that it has a credible basis under applicable tax law. It requires professional judgment and due care, including reviewing relevant facts, legislation, court decisions, and assessing the likelihood of the arrangement being accepted by tax authorities.

This means the accountant must be able to reasonably conclude that the plan's tax consequences are consistent with the law. If doubt exists, involvement should be avoided.

-

Professional Judgment

The standard stresses the importance of sound professional judgment. Accountants must weigh the risks of aggressive tax interpretations, potential scrutiny by tax authorities, and reputational consequences for both the client and accountants.

-

Documentation

When providing a tax planning service, a professional accountant is encouraged to document on a timely basis. This includes recording the purpose of the plan, the analysis, the judgments made, and any disagreements with the client.

The revised EP 100 elevates ethical expectations in tax advisory work. It shifts the focus from technical compliance to a broader, values-driven approach, ensuring that tax plans are not only legally defensible but also ethically responsible. The goal is to discourage participation in schemes that exploit legal loopholes without genuine economic substance.

II. Key Changes and Considerations on Key Audit Partners (KAPs) Implementation Guide

The EP 100 IG 2 (Revised 2025) highlighted several key considerations on the revisions that are summarised below. The IG also included a new Frequently Asked Questions (FAQs) section to provide clearer direction on applying the rotation rules. These FAQs address various scenarios that were not explicitly covered before.

1.The expanded definition of KAPs pertains to who qualifies as Key Audit Partner. They are highlighted as below.

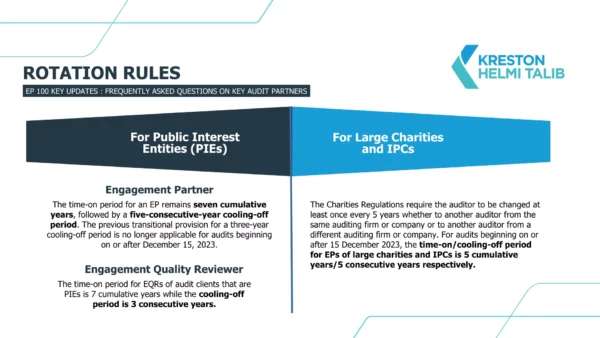

2. Rotation rules for EPs who'll lead certain audit engagements vary for different types of businesses.

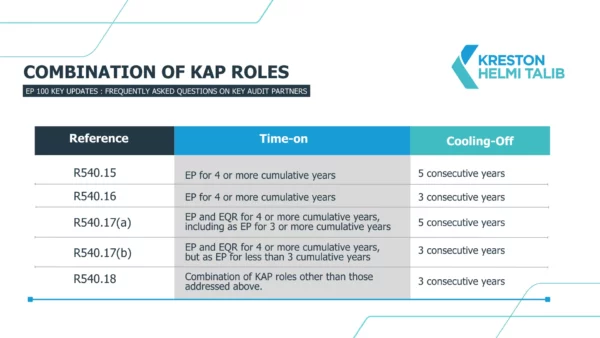

3. For PIE audit clients, the required cooling-off period for KAPs with combined roles as prescribed in EP 100 and the Accounting & Corporate Regulatory Authority (ACRA) Code now follows a detailed matrix.

4. Considerations on cooling-off period.

The rotation requirements under EP 100 are based on the cumulative time an individual serves as a Key Audit Partner (KAP), which is generally limited to seven years. However, paragraph 540.3 A3 highlights that firms should also consider the total duration of the individual’s involvement with the client, their roles, and time on the engagement team. Based on this assessment, early rotation or a cooling-off period may be appropriate even before the seven-year limit is reached to remove/reduce possible threat created by long association.

The revised EP 100 IG 2 provides more detailed, scenario-based approach to the application of partner rotation rules. The guidance aims to eliminate ambiguities and ensure strict adherence to independence requirements, especially for the audits of PIEs. For more information, visit ISCA's Implementation Guide (2) in this link.

All materials have been prepared for general information purposes only. The information presented in this article is not legal advice, and is not to be acted on as such, may not be current and is subject to change without notice. Professional advisory should be sought before taking or refraining from any action as a result of the contents in this document.