The Institute of Singapore Chartered Accountants (ISCA) has recently issued Ethics Pronouncement (EP) 200 Implementation Guidelines (IG)1. The guidelines provide practical know-hows for professional accountants in Singapore to ensure compliance with Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) requirements. It clarifies key obligations, outlines risk-based approaches, and helps firms implement effective safeguards to detect and prevent financial crime.

Key Considerations

The updated standard introduces a more rigorous framework for identifying and managing ethical risks in tax planning engagements.

Below is a concise breakdown of the key considerations to note.

1. Definitions and Terminologies

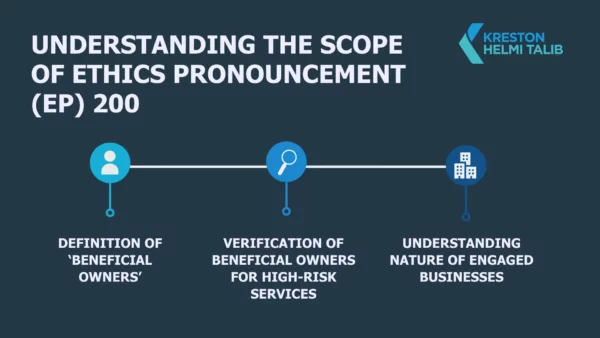

To better apply the scope of the new framework, professional services firms and accounting practitioners should have an in-depth understanding of the terms and definitions in the standard. Particularly as highlighted.

The Professional Services firms should be aware of the definition of a Beneficial Owner, including non-exhaustive examples according to the type of clients they may have. The professional firm is required to identify the client’s beneficial owners and to take reasonable measures to verify these beneficial owners when it performs any designated high-risk services. The professional firms shall understand, and as appropriate, obtain information on the purpose and intended nature of the business relationship.

2. Internal Policies and Controls

Accounting practitioners are at the forefront of detecting and monitoring transactions at risk of money laundering and terrorist financing (MLTF) amongst businesses they engage with. To ensure this purpose is served, the standard issued below guidelines in designing and implementing controls within the organisation.

- Professional firms must develop and implement internal policies, procedures, and controls to address MLTF concerns and communicate these to their employees.

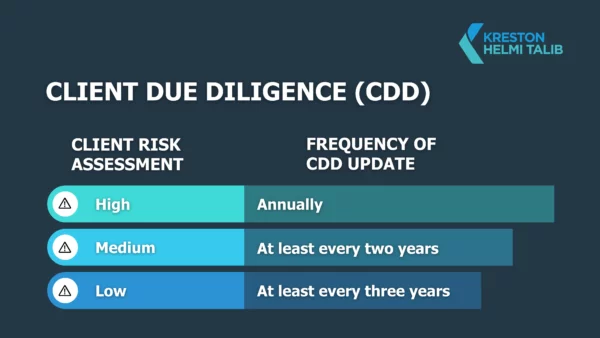

- An accounting entity or individual practitioner shall apply Customer Due Diligence (CDD) measures to its existing clients based on its own assessment of risk, considering when and whether any CDD had previously been applied to such existing clients, the adequacy of documents, data and information obtained and any change in circumstances or nature of services provided to its clients.

- For “designated high-risk services,” all accounting entities and their individual practitioners must screen clients and related parties against relevant MLTF. This includes the client, their agents, connected parties, and beneficial owners.

- Where screening results in a positive hit against sanctions lists, professional accountants are obliged to cease all dealings with the designated persons and entities.

- Professional firms performing any designated high-risk services are required to monitor its business relations with its clients on an ongoing basis.

- Ongoing monitoring to determine the need to update CDD information should be considered at appropriate times, using a risk-based approach, based on the professional firm’s knowledge of the client and the nature of services provided by the professional firm.

- Professional firms must implement enhanced CDD and ongoing monitoring for clients who pose a high risk of money laundering or terrorism financing. This is mandatory for complex or unusual transactions, clients from countries with inadequate anti-money laundering (AML)/counter-terrorist financing (CFT) measures, or any other high-risk situations identified by the firm or the Registrar.

- For non-face-to-face clients, firms must apply professional judgment to mitigate the higher risk by taking additional steps to verify identity, such as using additional documents, real-time video calls, or requiring payments through a bank account in the client’s name at a Singapore financial institution.

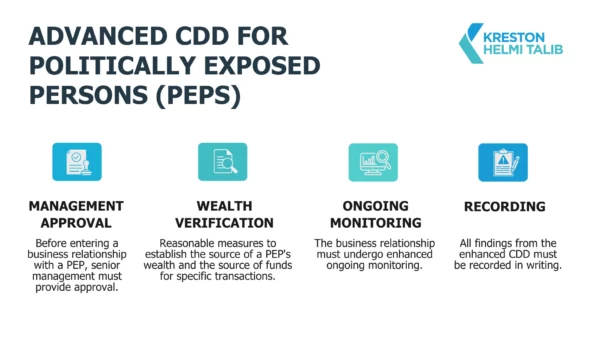

- Professional firms must apply enhanced Customer Due Diligence (CDD) for Politically Exposed Persons (PEPs), which include foreign PEPs, high-risk domestic PEPs, international PEPs, and even those who have stepped down. This also extends to their immediate family and close associates.

3. Enforcement and Reporting

If a professional accountant has grounds for suspicion, they must promptly alert their compliance officer or senior management. A Suspicious Transaction Report (STR) must then be filed with the Suspicious Transaction Reporting Office (STRO) within five business days, or within one business day for high-risk cases like Targeted Financial Sanctions. If there is a risk of “tipping-off” the client, the accountant can stop performing customer due diligence measures but must file an STR immediately and document the reason for doing so.

In a nutshell, EP 200 IG 1 helps accountants translate AML/CFT regulations into practical steps. It emphasizes a risk-based approach, proactive client screening, and documentation of all due diligence efforts. The guidance aligns with international standards and is designed to protect firms from being unwitting conduits for illicit financial activity.

All materials have been prepared for general information purposes only. The information presented in this article is not legal advice, and is not to be acted on as such, may not be current and is subject to change without notice. Professional advisory should be sought before taking or refraining from any action as a result of the contents in this document.