The International Sustainability Standards Board (ISSB) has released the IFRS Sustainability Disclosure Standards, a global framework for consistent, comparable, and high-quality sustainability reporting. These standards, designed to meet investor needs, include IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosures, which were issued on 26 June 2023 and become effective for periods beginning on or after 1 January 2024.

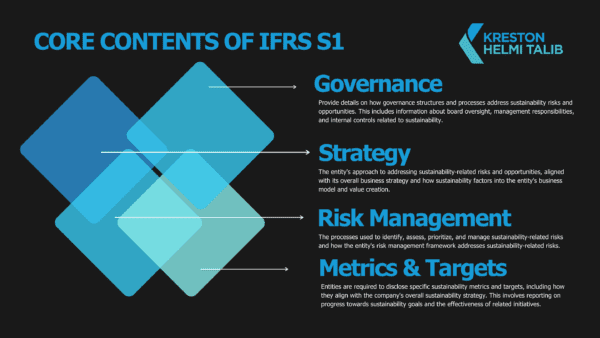

Core Contents of IFRS S1

IFRS S1

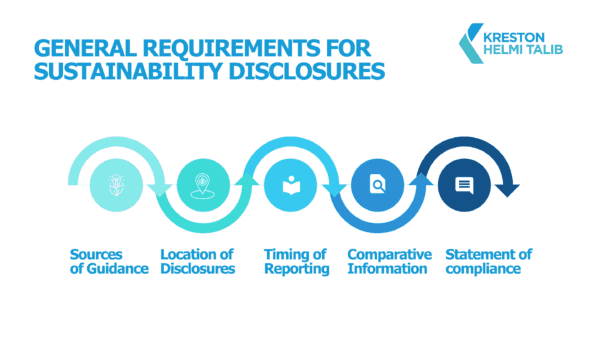

General Disclosures: IFRS S1 mandates that entities disclose information about their sustainability-related risks and opportunities arising up and down the reporting entity’s value chain, including their impact on financial performance and position.

Identifying and disclosing all material risks and opportunities related to sustainability can be done through the steps illustrated below.

IFRS S2 Climate-Related Disclosures

IFRS S2 focuses specifically on climate-related risks and opportunities, providing a framework for reporting climate-related information in accordance with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). The standard aims to enhance the consistency and comparability of climate-related disclosures across entities. It applies to:

- Climate-related risks to which the entity is exposed, namely climate-related physical and transition risks; and

- Climate-related opportunities available to the entity

All materials have been prepared for general information purposes only. The information presented in this document is not legal advice, is not to be acted on as such, may not be current and is subject to change without notice. Professional advisory should be sought before taking or refraining from any action as a result of the contents of this document. Details are based on the information as of 20 September 2024.