Singapore Budget 2024: Insights and Support Measures for the Year and Beyond

Budget 2024 is all encompassing as it tackles immediate uncertainties in the economic outlook, inflation, rising business costs and cost of living. The Budget aims to be inclusive, pro-business, pro-Singaporeans and thrust Singapore forward against a competitive global landscape whilst remaining socially cohesive.

![]()

A. Tax Changes For Businesses

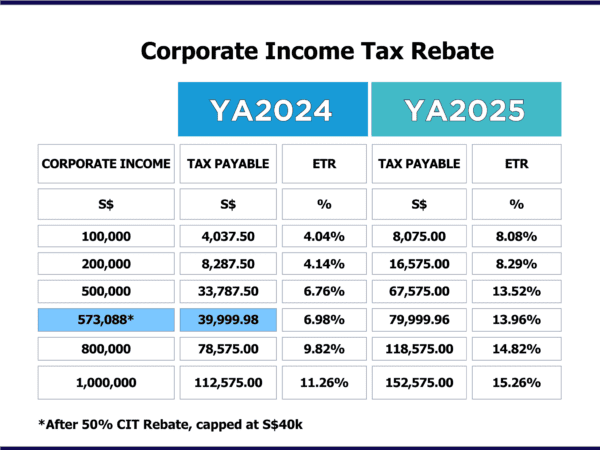

1. Corporate Income Tax (CIT) Rebate

- All companies (including registered business trusts and variable capital companies) will receive CIT Rebate of 50% of tax payable for YA 2024.

- This will be applied automatically to their tax assessments for YA 2024 after submitting Form C-S/ Form C-S (Lite)/ Form C.

- Companies who have met the Local Employee Condition [made CPF contributions to at least one local (i.e., Singapore Citizen or Permanent Resident employee] in 2023 will receive a minimum CIT Rebate Cash Grant of $2,000. This will be granted automatically by IRAS by Q3 of 2024

- The CIT Rebate Cash Grant is not taxable.

- The maximum total benefits of CIT Rebate and CIT Rebate Cash Grant that a company may receive is $40,000.

Our Comments:

A Chargeable Income (CI) of S$573,088 would reap the maximum S$40,000 in CIT rebate. CI of more than S$573,088 would not increase the rebate as the maximum of S$40,000 is reached.

The minimum S$2,000 Cash Grant is a welcome move that benefits non-tax paying companies or those in a loss position for YA2024. For a company whose CIT rebate is S$2,000 or less (and meets the Local Employee Condition), it will only receive the S$2,000 Cash Grant (no further CIT rebate).

A company may consider deferring its capital allowance claim this YA2024 if its CI is S$573,088 and below to take opportunity of the lower income taxes made possible by the very generous 50% CIT Rebate. The CA deferred can thus be claimed come YA2025 especially if the business is expected to be profitable then.

2. Renovation or Refurbishment (R&R) Expenditure S14N

- To ease businesses’ compliance burden and improve the scheme’s relevance, the following enhancement is introduced from YA2025:

- Qualifying expenditure scope will expand to include designer fees or professional fees.

- The first relevant 3-year period will be made uniform across to start from YA 2025 to YA 2027 for purposes of computing the R&R S$300,000 cap.

- An option to claim R&R deductions in one YA, subject to the prevailing expenditure cap of $300,000 for every relevant 3-year period.

Our Comments:

The S14N single YA claim was also announced for YA 2024 in last year’s Budget – 2023. From YA2025, S14N is available on a 1-year claim, if opted for.

3. Income Inclusion Rule (IIR) and Domestic Top-up Tax (DTT)

True to Budget 2023 announcements, Singapore goes ahead with 2 components of BEPS 2.0 Pillar 2 rules that introduce a minimum effective tax rate (ETR) of 15% for MNEs with consolidated group revenue of at least €750m.

- Effective 1 Jan 2025, Singapore implements IIR and DTT to collect a top-up tax when the ETR falls below 15%.

- Ensures top-up taxes are collected here rather than elsewhere

- UK, Germany, Australia, Japan & Korea implemented top-up taxes since 1 Jan 2024.

- The IIR and DTT will apply to multinational entities (‘MNEs‘) with consolidated group revenue of €750m or more in at least 2 of 4 prior years.

- IIR applies to MNE groups parented in Singapore, on their overseas group profits (ie entities operating outside Singapore).

- DTT applies to MNE groups headquartered outside Singapore in respect of low-taxed profits of group entities operating in Singapore.

- Another Pillar 2 Rule, Undertaxed Profits Rule (UTPR) is to be considered at a later stage.

- UTPR allows Singapore to claim a share of Top-Up Tax collected by other tax authorities from any MNE with operations here, if any portion of its overseas income has not been subject to minimum ETR in that foreign jurisdiction.

BEPS 2.0 has 2 Pillars.

4. Refundable Investment Credit (RIC)

The RIC was introduced to counter BEPS 2.0 Pillar 2’s minimum 15% ETR rule negating Singapore’s current tax incentives in exempting income.

- Require an application to EDB or EnterpriseSG

- RIC is a credit given up to 50% of qualifying expenditure in each category

- Credit can be offset against Corporate Income Tax payable

- RIC features a cash component – unused credits will be refunded to the Company in cash within 4 years of its meeting the conditions & receipt

- Scheme is consistent with the “Qualified Refundable Tax Credits” outlined in the Pillar 2 rules

- Seeks to reduce the likelihood of top-up tax imposed under GloBE rules

- Qualifying period of up to 10 years

The RIC supports high-value and substantive economic activities in the following key sectors and new growth areas:

- New productive capacity (e.g., new manufacturing plant, production of low-carbon energy).

- Expanding/establishing scope of activities in digital, professional services, supply chain management.

- Expanding or establishing headquarter activities, Centres of Excellence.

- Setting up or expanding commodity trading firm activities.

- R&D and innovation

- Implementing solutions with decarbonisation objectives.

Depending on project type, qualifying expenditure categories may include:

- Capital expenditure

- Manpower costs

- Training costs

- Professional fees

- Intangible asset costs

- Fees for work outsourced in Singapore

- Materials and consumables; and

- Freight and logistics cost

RIC given is dependent on predetermined support rates for various categories.

Further information will be available on EDB and EnterpriseSG websites by Q3 2024.

Our Comments:

The RIC scheme has been adopted by Belgium and Ireland for R&D activities. Interested companies can approach EDB or EnterpriseSG to apply the RIC (up to 50% of expenditure per category).

There is to be no double incentivising— if 40% of total R&D expenditure S$500,000 ie S$200,000 is given for RIC, only the remaining S$300,000 may go under Enterprise Innovation Scheme (“EIS”) claim where a further 300% tax deduction may be sought on S$300,000.

Companies may thus have to weigh the benefits of applying the RIC versus that given under EIS on qualifying expenditure.

5. Tax Incentive Schemes for Funds

To grow Singapore’s asset and wealth management industry, these fund incentives will be extended another 5 years to 31 December 2029:

- S13D – Offshore Fund Tax Incentive

- no economic conditions – no minimum Asset Under Management (“AUM”) or Total Business Spending (TBS)

- S13O – Onshore Fund Tax Incentive

- For Singapore tax resident companies (currently set up as Singapore private limited companies or variable capital companies (VCC) only), no minimum AUM, TBS can be local/overseas

- S13U – Enhanced Tier Tax Incentive

- Minimum S$50m AUM, TBS is for local spending only

Effective 1 January 2025, the following changes will apply:

- S13O incentive to include Limited Partnerships (LLP)

- Economic Qualifying Criteria for all 3 S13 schemes will be revised (does this mean a higher minimum AUM, TBS)

Qualifying Funds managed by Singapore-based fund managers will continue to enjoy:

- Tax exemption on specified income derived from designated investments.

- WHT exemption on interest/other qualifying payments to non-residents

- GST remission

MAS will provide further details by 3Q 2024.

Our Comments:

It remains to be seen if the revised economic qualifying criteria will impact only new applicants to the fund incentives come 1 January 2025 or those already granted them.

6. Alternative Basis of Taxation for Maritime Sector Incentive (MSI) Schemes

- Currently, qualifying income (“QI”) of shipping entities (“SEs”) under these MSI schemes is tax exempt

- MSI – Shipping Enterprise (Singapore Registry of Ship) (MSI-SRS)

- MSI – Approved International Shipping Enterprise (MSI-AIS)

- MSI – Maritime Leasing (Ship) [MSI-ML(Ship)]

- From YA 2024, QI of SEs may be taxed with reference made to net tonnage of their ships.

- The alternative basis of tax will apply to all qualifying ships of MSI entities that are subjected to it.

- Should MSI entities NOT opt for this net tonnage tax, existing tax treatment will continue to apply

Our Comments:

The net tonnage tax is already adopted by many European countries eg UK and the Netherlands — it generally refers to the cargo carrying capacity of the ships. This basis of tax simplifies, provides more certainty to the tax payable and better aligns the tax reporting of international shipping groups with their overseas counterparts.

SEs may opt for this alternative tax especially if the economic commitment conditions are less onerous than that of the existing MSI schemes. Paying more income taxes upfront under the net tonnage regime may also provide some relief in lower top-up taxes being clawed back subsequently under Pillar 2 rules.

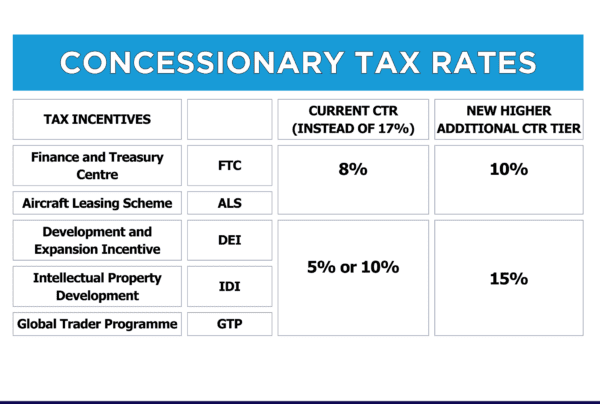

7. New 15%/10% Concessionary Tax Rate (CTR) Tier

From 17 February 2024, an additional CTR tier will be introduced to these tax incentives:

Our Comments:

With a new tax rate closer to the minimum ETR of 15%, our tax incentives remain competitive and relevant in a post-BEPS world.

Companies may benefit from the “higher tax rate” especially for those that cannot meet the heftier commitment levels required to be eligible to the lower tax rate.

8. Additional Buyer’s Stamp Duty (“ABSD”) Remission Clawback for Housing Developers (HDs)

- Currently, HDs that purchase residential land on or after 16 Dec 2021 are subject to 40% ABSD, comprising a

- (i) 5% non-remittable component; and

- (ii) 35% upfront remittable component.

- If a licensed HD of 5 or more residential units fails to sell all its residential units within 5 years from the day he buys the land, the 35% component will be clawed back with interest at 5% per annum.

- From 16 February 2024, HDs with at least 90% units sold at the 5-year sales timeline and fulfilling commencement and completion criteria for projects purchased on or after 6 July 2018, will be subjected to lower ABSD remission claw back rate.

- Instead of a flat 35% claw back rate (for land purchased on or after 16 Dec 2021), such will be reduced from 1% to 10% points, depending on proportion of units sold at the five-year end mark.

- Those with less than 90% units sold by the 5-year end timeframe will continue to be hit with the 25% (for land purchased between 6 July 2018 and 15 Dec 2021) & 35% (for land purchased from 16 Dec 2021) claw back rate.

Revised ABSD remission clawback rates for projects depending on date of acquisition of residential site and proportion of units sold at the prescribed sale timeline (assuming commencement and completion of housing development timelines are met.

![]()

Our Comments:

The government is timely in addressing HD’s concerns in the challenging landscape today where a significant increase in private housing units in 2023 (9,000+) may ease demand and prices.

The change may not be that significant however, since the ABSD clawback is computed based on land acquisition costs, not on units unsold. Nonetheless, the relief given to the property sector is welcomed.

B. Tax Changes For Individuals

1. Personal Income Tax (PIT) Rebate

-

All tax resident individuals will be granted 50% PIT rebate for YA 2024 capped at $200.

Our Comments:

An individual with a Chargeable Income (CI – Assessable Income less Personal Reliefs) of S$20,000 does not pay any income taxes.

One with a CI of S$35,715 in YA2024 will get the maximum 50% tax rebate of S$200. Any CI above S$35,715 will not see any increase in the rebate.

It is the intention that this rebate benefit the lower income individuals.

2. Raised Income Thresholds for Dependant-Related Reliefs to S$8,000

- Currently, the annual income of a dependant (non-handicapped spouse or siblings) or caregiver cannot exceed S$4,000 in the taxable calendar year if a tax resident individual would like to claim dependant-related reliefs.

- For Cash Top-up relief, the annual income threshold does not apply to spouse/siblings who are handicapped.

- For Grandparent Caregiver relief, the annual income of the Caregiver only pertains to those that comes from trade, business, profession, vocation and employment.

- Effective YA 2025, the income threshold for the following dependant-related reliefs will be increased to $8,000:

- Spouse relief

- Parent relief

- Qualifying child relief

- Working Mother’s Child relief

- CPF Cash Top-up Relief for top-up to the CPF account of spouse or siblings

- Grandparent Caregiver relief

Aside from the increase in the income threshold from the current S$4,000, there is no change to the other conditions.

Our Comments:

This will allow more taxpayers to benefit whilst enabling their dependant-family members to do some work.

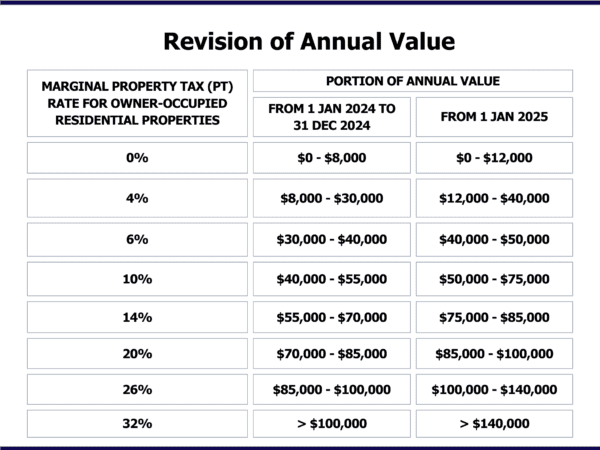

3. Revision of Annual Value (AV)

- Property tax is derived by multiplying an applicable tax rate to the AV.

- From 1 January 2025, there will be an adjustment to AV bands specifically for each owner-occupier residential rates.

Our Comments:

Amidst rising AVs over the last 2 years (from a buoyant property market), this AV band revision will result in overall lower PT to be paid for owner-occupied properties if the AV remains same. (eg., for an AV of S$30,000, the PT payable of S$720 for year 2025 is S$160 lower than S$880 in 2024.)

4. Extended GIRO Scheme for Residential Property

- Previously, GIRO instalments are limited to 12 months

- From PT bill 2024, GIRO instalment can be extended from 12 to 24 months for retirees who meet the criteria:

- All owners of the property are aged 65 and above.

- The applicant must owner-occupy the residential property; and

- The applicant’s Assessable Income must not exceed S34,000

- Eligible retirees can apply via myTaxPortal from 19 February 2024 onwards

Our Comments:

This will alleviate the cash flow of retired/semi-retired home-owners coping with escalating property tax bills from a higher AV.

5. New ABSD Concession for Single Singapore Citizen (SC) seniors

- Previously, only SC married couples are entitled to ABSD concession.

- Now, the concession is extended to single SC seniors aged 55 and above when buying a replacement residential private property (RP) on or after 16 Feb 2024, provided certain conditions are fulfilled

Our Comments:

This will better support single SC seniors looking to right-size their RP to one of a lower value than their current unit.

6. Course Fee Relief

- Course Fees Relief (CFR) of up to S$5,500 available to individuals per YA will lapse effective YA 2026.

- Singaporeans aged 40 and above may continue to receive more targeted direct support through The SkillsFuture Level-Up Programme .

- The Skills-Future Level Up Programme comprises 3 measures:

- S$4,000 SkillsFuture Credit (Mid-career) Top-Up

- S$4,000 SFC (Mid-Career) top-up will be provided to every Singaporean in the year they turn 40 years old.

- Singaporeans currently aged 40 and above will receive the top-up by May 2024.

- SFC credit will have no expiry date

- Pursue another subsidized Full-time Diploma

- Singaporeans aged 40 and above will qualify for the Mid-career Enhanced Subsidy for another full-time diploma at our Polytechnics, ITE, NAFA and LASALLE College of the Arts.

- SkillsFuture Mid-Career Training Allowance

- Available to mid-career workers from early 2025 who enroll in full-time long-form training programmes.

- SkillsFuture Career Transition Programme courses that support mid-career transitions to sectors with good hiring opportunities; and

- Qualifications up to undergraduate degree level offered by our Institutes of Higher Learning and Arts Institutions.

- Training allowance (TA) equivalent to 50% the individual’s average income over the latest 12-month period is given.

- TA capped at $3,000 per month up to 24 months

- S$4,000 SkillsFuture Credit (Mid-career) Top-Up

7. Remove CPF Cash Top-Up Relief for Cash Top-ups that Attract Matched Retirement Savings Scheme (MRSS)

- Currently cash top-ups to retirement accounts that attract MRSS matching grant will entitle the giver to the CPF Cash top-up relief.

- Cash top-ups made on or after 1 Jan 2025 to the Retirement Account of a CPF member who is eligible to the MRSS matching grant will no longer entitle the giver to the CPF Cash top-up relief.

- From 1 Jan 2025, the MRSS is enhanced from S$600 to S$2,000 a year with a S$20k cap over a member’s lifetime.

- Whereas previously the MRSS was only given to a person 55 to 70 years old, the 70 year old cap is removed – ie a CPF member 80 years may qualify for MRSS

- For cash top ups that do not attract the MRSS matching grant, the giver may continue to enjoy tax relief up to S$16,000 annually for top-ups to:

- Own Special / Retirement / MediSave Account (S$8,000); and

- Accounts of loved ones (another S$8,000)

C. Other Tax Changes

1. Overseas Humanitarian Assistance Tax Deduction Scheme (OHAS)

- Tax deduction to corporate and individual donors for their qualifying overseas cash donations

- Qualifying overseas cash donations means it is made through:

- a designated charity (the list of which is available from 1 Jan 2025)

- towards a fund-raiser for emergency humanitarian assistance with a valid Fund-Raising for Foreign Charitable Purposes (FRFCP) permit from the Commissioner of Charities (COC)

- Set to commence over 4 years from 1 January 2025 to 31 December 2028

- Tax deductions will be capped at 40% of donor’s statutory income.

- If the donor receives tax deductions under Philanthropy Tax Incentive Scheme for Family Offices (PTIS) (ie those with S13O or S13U fund) alongside OHAS, the tax deduction under both OHAS and PTIS will be jointly capped at 40% his statutory income.

- Any unutilised tax deductions under OHAS cannot be carried forward to offset donor’s income for subsequent YA or transferred under the Group Relief System for any YA.

- Tax deductions will be capped at 40% of donor’s statutory income.

2. Withdraw Income Tax Concession on Royalty Income

- Tax concession applies for royalty income received by individuals on literary, dramatic, musical or artistic work.

- The current concessionary treatment is to tax the lower of:

- Net amount of royalties (amount of royalties after allowable deductions and capital allowances); or

- 10% of the gross royalties

- From YA2027, the income reporting will still be the lower of i) versus ii) except that for ii), the % will go up by 30% points each year to 40% in YA2027 and 70% for YA2028.

- From YA 2029, taxpayers should report the net amount of royalties

All materials have been prepared for general information purposes only. The information presented in this document is not legal advice, is not to be acted on as such, may not be current and is subject to change without notice. Professional advisory should be sought before taking or refraining from any action as a result of the contents of this document.