Onward Together for a Better Future Tomorrow

Budget 2025 is for all, with all Singaporeans as it works toward a better future tomorrow against global uncertainty and an increasingly competitive global landscape. Prime Minister Lawrence Wong, tackled vital key areas of focus and development during his speech that covered:

-

- Inflation and Living/Business Cost Pressures

- Business Internationalisation

- Technology, Innovation, and Infrastructure

- Equipped Workers throughout Life

- Sustainable City

- Socially Cohesive, Caring, and Nurturing Society.

The Government announced strategies to strengthen fiscal resilience, support long-term economic growth, and incorporate sustainability concerns.

I. Enhance Technology and Innovation Engines

1. National Productivity Fund:

S$3 billion top up to enhance productivity, workforce training, maximise our competitive strengths in anchoring more high-quality investments against major global contenders.

2. Research and Development Infrastructure:

S$1 billion investment for cutting-edge R&D infrastructure, focusing on:

-

-

-

-

Biotech sector

- Refresh/Upgrade public biosciences and Medtech infrastructure to promote collaboration within research community and enable faster translation of research into commercial solutions

-

Semiconductor space

- Develop a new national semiconductor R&D fabrication facility for researchers and industry partners to prototype and test new innovations

-

-

-

II. Strengthen Enterprise Ecosystem

1. Enterprise Compute Initiative:

Up to S$150 million will be used to assist companies to leverage AI solutions more effectively in their transformation journey. Eligible enterprises will be partnered with major cloud service providers to access AI tools, computing power and expert consultancy services.

2. Private Credit Growth Fund:

A new S$1 billion fund will be introduced to provide financing options for high-growth Singapore-based enterprises, closing a gap in the private credit market’s offers primarily focused outside Asia.

3. Launch Global Founder Programme:

EDB to launch later this year, an initiative to encourage global founders (multinationals, experienced entrepreneurs) to anchor and grow more new ventures in Singapore.

III. Support for Businesses/Workforce

1. SkillsFuture Workforce Development Grant:

Up to 70% funding support for job redesign, simplify the application process for employers.

2. Redesigned SkillsFuture Enterprise Credit:

Eligible companies with at least 3 resident employees will receive a S$10,000 credit (operate like online wallet) in 2nd half of 2026 lasting 3 years to offset costs for workforce transformation and training courses.

Companies can continue to use its existing credit, the expiration of which will be extended from June 2025 to 2nd half of 2026 when the new credit is ready.

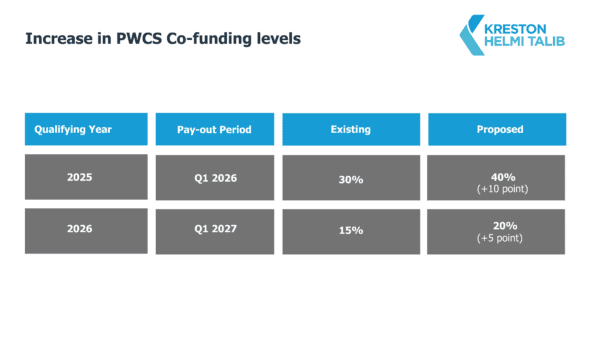

3. Progressive Wage Credit Scheme Enhancement:

The Government’s co-funding for wage increases will rise from 30% to 40% in 2025 and from 15% to 20% in 2026 to aid businesses to lift lower-wage workers.

As President Trump’s tariffs send the global economy into a tailspin of uncertainty, stock market meltdown and dampened confidence, Singapore has not been spared either, being hit with a blanket 10% minimum tariff, despite our running a trade deficit position with the US (ie we buy more from the US than they from us).

China has already imposed a retaliatory 34% tariff on US goods with the US countering an additional 50%, taking its total tariffs on China to 104%. This could signal an impending global trade war.

Besides the Budget measures, PM Lawrence Wong has now set up economic agencies to engage impacted firms for support. A Taskforce will also help businesses and workers address immediate uncertainties, strengthen competitiveness and adapt to the new protectionist environment.

Closer collaboration with like-minded partners open to free trade are forged – eg UK is keen to do more with Singapore in new areas like the digital and green economies.

Singapore will work to accelerate ASEAN’s integration efforts in making ASEAN more attractive and competitive.

To thrive and remain successful long-term, Singapore will continue to be rules-based, advocate free trade so investors feel safe to do business here – mobilise their capital, gather talent here and know their intellectual property will be safeguarded.

Tax Changes

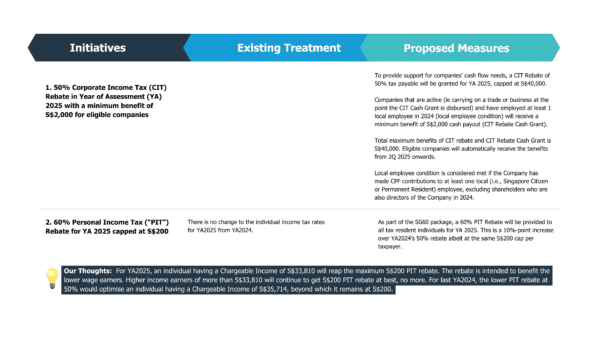

1. Supporting Companies and Individuals

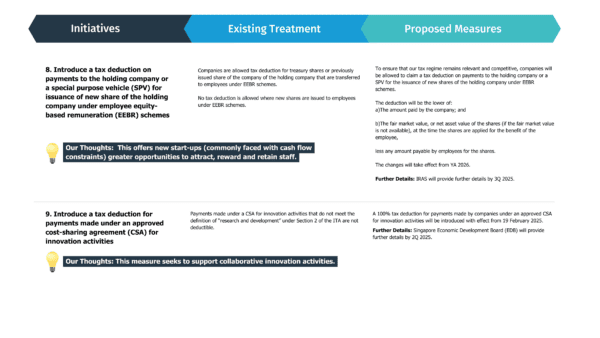

2. Fair and Competitive Tax System

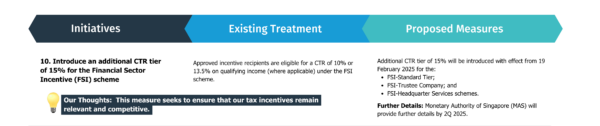

2.a. Financial Services Incentives

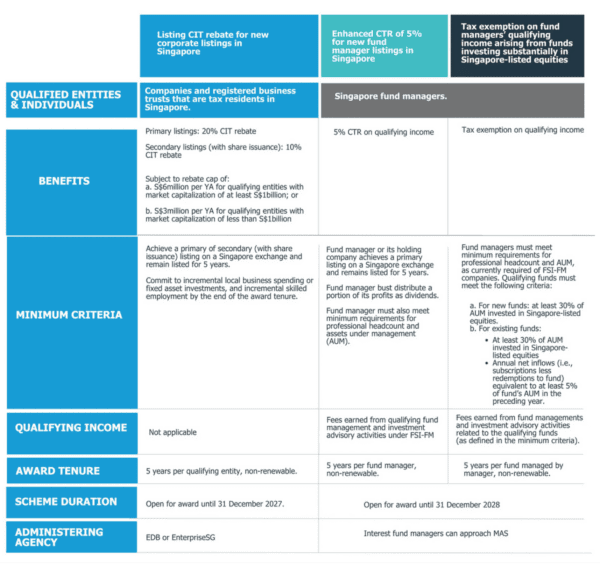

2.b. Tax Incentives Recommended by Equities Market Review Group

To encourage new listings in Singapore and increase investment demand for Singapore-listed equities, the following tax incentives will be introduced:

-

- Listing CIT rebate of 10% / 20% for new corporate listings in Singapore, subject to rebate cap of:

- S$6million per YA for qualifying entities with market capitalization of at least S$1billion

- S$3million per YA for qualifying entities with market capitalization of less than S$1billion

- Enhanced CTR of 5% for new fund manager listings in Singapore; and

- Tax exemption on fund managers’ qualifying income arising from funds investing substantially in Singapore-listed equities.

- Listing CIT rebate of 10% / 20% for new corporate listings in Singapore, subject to rebate cap of:

Our Thoughts:These measures are designed to attract new listings and investment demand for Singapore-listed equities, contributing to the overall vibrancy of the market.

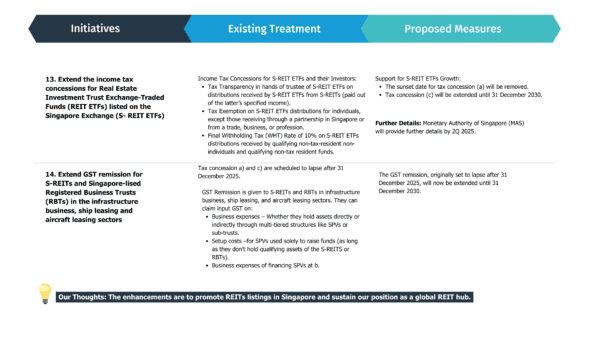

2.c. Real Estate Investment Trust

3. Strengthening Employment Support

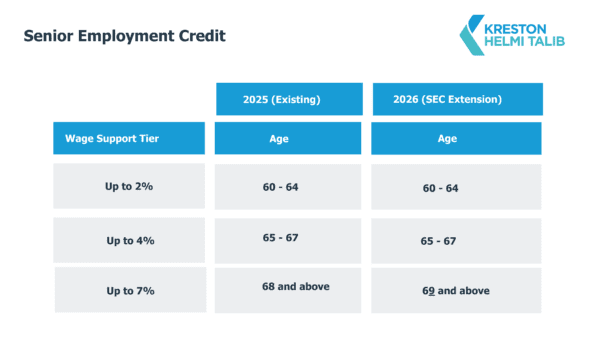

3.a. Extending Senior Employment Credit (SEC)

The Senior Employment Credit (SEC) scheme, which provides wage offsets to Employers hiring Singaporean workers aged 60 and above earning up to $4,000 monthly, will be extended a year from 31 December 2025 to 2026 with an up to 7% wage support tier for hiring workers aged 69 and above (from 68) in view that the re-employment age is raised from 68 to 69 in 2026.

Further details will be announced at the Minsitry of Manpower (MOM) Committee of Supply.

Our Thoughts: The enhanced PWC co-funding and proposed SEC extensions show strong support for both lower-wage and senior workers, helping businesses manage costs while building a more inclusive and resilient workforce.

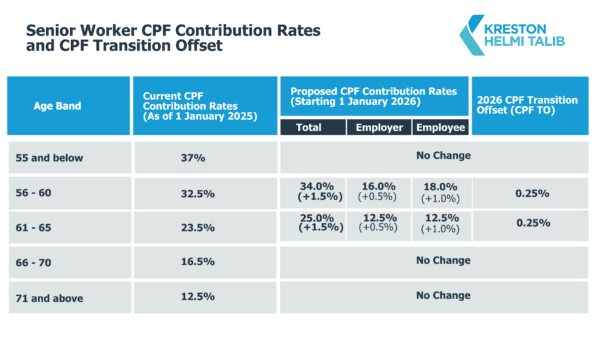

3.b. Senior Worker CPF Contribution Rates and CPF Transition Offset

It was proposed in 2019 that the CPF rates would be raised gradually for Singaporeans and Permanent Resident workers aged above 55 to 70. The next increase for those aged 56-65 will take place on 1 January 2026 with a 1.5% point increase in Employer (0.5%) and Employee (1.0%) rates combined.

To mitigate the rise in business costs, the Government will give automatically, a one-year CPF Transition Offset equal to *half the 2026 increase in Employer CPF contribution.Our Thoughts: The increase in CPF contributions will help senior workers save more for retirement, while the CPF TO will mitigate rising business costs to employers.

3.c. Enhancing the Progressive Wage Credit Scheme

Progressive Wage Credit Scheme (PWCS) was introduced in Budget 2022 to provide support for employers to cope with mandatory wage increases of lower-wage workers.

The PWCS co-funding will be enhanced from

-

- 30% to 40% for wage increases given in 2025 and

- 15% to 20% for those given in 2026.

Employers can expect the payout for 2025 by 1Q 2026.

4. Encouraging Life-long Learning

Extending Skills Future Mid-Career Training Allowance to Part-Time Training:

The SkillsFuture Mid-Career Training Allowance under SFLP applies to Full-Time Training and is now extended to Part-Time, long-form Training.

The SkillsFuture Level-Up Programme (SFLP) introduced in Budget 2024 aims to support mid-career Singaporeans aged 40 and above to stay relevant by upskilling and reskilling.

The enhancement to part-time courses aims to enable mid-career workers to gain relevant skills and remain adaptable in a rapidly changing job market.

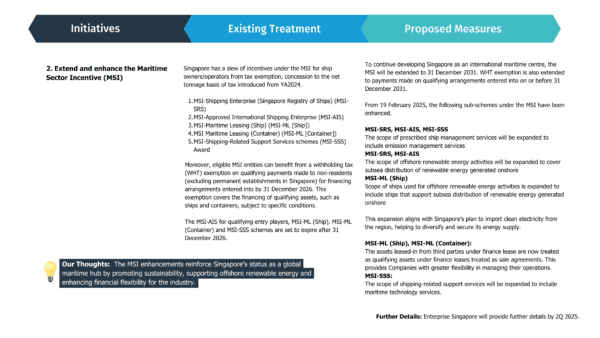

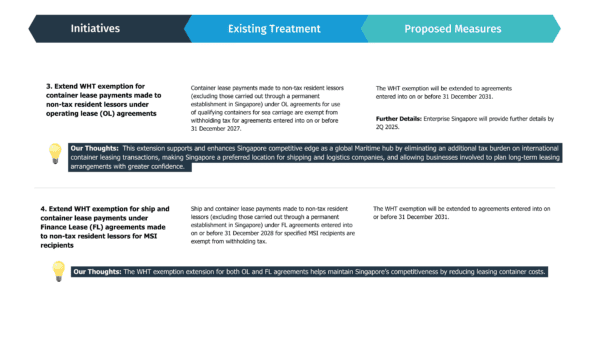

5. Maritime & Shipping Tax Changes

To maintain Singapore’s position as a leading maritime and shipping hub, the latest tax updates for the maritime industry are introduced to enhance competitiveness, attract global investments, and support sustainable growth.

All materials have been prepared for general information purposes only. The information presented in this article is not legal advice, and is not to be acted on as such, may not be current and is subject to change without notice. Professional advisory should be sought before taking or refraining from any action as a result of the contents in this document. For questions or clarifications, reach out to our Tax Advisory team.