- All

- Why Singapore

- Immigration

- Getting Started

- Business Administration

- Compliance Requirements

- Tax

- Industry

- News & Insights

Starting A Shipping Company in Singapore

Singapore is home to more than 5,000 maritime establishments, holding headquarters of 140 of the world’s top shipping groups. With the added advantage of having several pro-business government policies, setting up a maritime business in Singapore is quick and easy. This section will take you through the essentials to setting up a shipping company in…

Starting a FinTech company in Singapore

As the world advances into a technologically connected global village, countries are constantly looking to expand their presence with the right infrastructure to catch up with the latest developments and innovative ideas that are up for grabs. In recent times, financial technology has been making headlines. Companies engaged in this field include both start-ups and established financial institutions who are trying…

Guide to Registering a Charity

This guide will provide you with an overview of the key aspects involved in registering a charity. Charities are designed as organisations which: Operate on a not-for-profit basis; Are set up exclusively for charitable purposes; and Carry out activities to achieve these purposes which benefit the public. For an organization to be registered as a charity,…

Guide to Filing your GST Return

The Goods and Services Tax was first introduced in Singapore in 2003 as part of a government reform to shift taxes from an income-based to a consumption-based system to boost the nation’s international competitiveness. It is a broad-based consumption tax levied on the import of goods, as well as nearly all supplies of goods and…

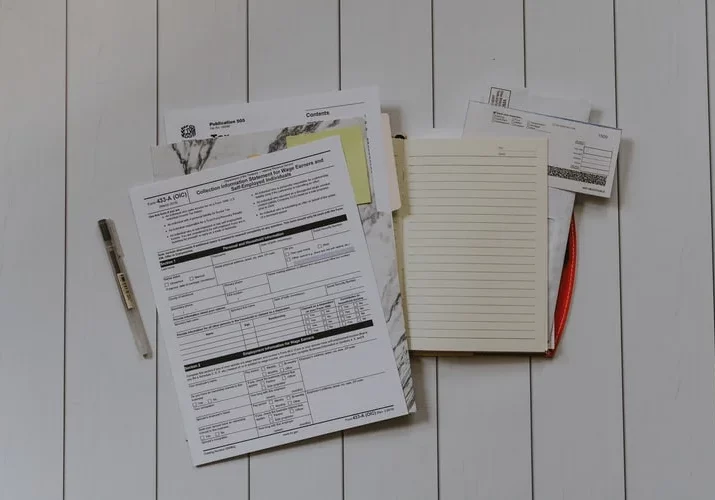

Filing Your Corporate Income Tax Return

Singapore serves as an attractive business hub for companies looking to expand into the emerging Asian Economy for numerous reasons, top of which include ease of setting up, attractive corporate and personal income tax rates, tax reliefs, absence of capital gains tax, and extensive double tax treaties. Singapore adopts a territorial basis of tax –…

Common mistakes made by businesses in filing income taxes

The following article covers common mistakes that businesses may often overlook when filing their income tax returns and what measures to follow to avoid them. If you discover any errors now, it is advisable to conduct a review of prior YAs as well and disclose them to IRAS as soon as the information collated is…

Changes on statutory requirements for AGMs and filing of AR

The following legislative changes in relation to AGMs and the filing of ARs are in effect since 31 August 2018. This is part of on-going efforts to keep Singapore business friendly and competitive as well as to reduce the regulatory burden of companies. The key changes are: Alignment of relevant statutory timelines for holding AGMs…

Guide to Filing Your Annual Returns

An annual return (AR) is an electronic document to be submitted to the Accounting and Corporate Regulatory Authority (ACRA). It is intended to keep the company’s particulars with ACRA up to date and to provide critical information that will help the company’s stakeholders to make informed decisions. This section will go through the essentials to…

Statutory Compliance Requirements

Companies that have been incorporated in Singapore are required to adhere to a set of compliance requirements as prescribed under the Accounting and Corporate Regulatory Authority (ACRA) and the Inland Revenue Authority of Singapore (IRAS) of the country. This section will give you an overview of essential filings and registrations that must be fulfilled. Filing…

Hiring Employees: All You Need to Know

Singapore has evolved into a global hotspot for talent, ranking #2 overall in the Global Talent Competitiveness Index 2021. Individual and foreign companies who have set up their offices on this island city will find themselves open to a pool of quality talents including professionals in multidisciplinary fields, skilled and semi-skilled labour to boost their…

Business Registration in Singapore: A Guide for Foreign Entrepreneurs (2026) Singapore remains a competitive hub for foreign investment, consistently ranking atop the world’s biggest economies.…

Read MoreTwo nations consistently sitting atop the five biggest economies in the world are in East Asia, China and Japan. Hong Kong, South Korea, and…

Read MoreThe Institute of Singapore Chartered Accountants (ISCA) has recently issued Ethics Pronouncement (EP) 200 Implementation Guidelines (IG)1. The guidelines provide practical know-hows for professional accountants…

Read MoreFor years, particularly in the Accounting industry, attracting and retaining talent has always been a challenge for most, if not all, firms. Singapore Opportunity Index…

Read MoreSingapore prides itself on its stringent financial controls and regulatory oversight, which make it an attractive hub for business expansion and foreign investments. The…

Read MoreWhy Global Connectivity Matters Over the years, business landscapes have significantly changed, driven by technological evolutions, global interconnectedness, shifts in consumer preferences, and the…

Read MoreSingapore’s Accountancy Body, the Institute of Singapore Chartered Accountants (ISCA), has released updates on Ethics Pronouncement (EP) 100 to incorporate revisions to the code. They…

Read MoreKreston Helmi Talib appointed Julius Magpantay as a new Audit Partner to further strengthen our audit capabilities, effective 1 July 2025, Julius began…

Read MoreSingapore is set to significantly strengthen its regulatory landscape for corporate service providers (CSPs) with the upcoming commencement of the Corporate Service Providers Act…

Read MoreOnward Together for a Better Future Tomorrow Budget 2025 is for all, with all Singaporeans as it works toward a better future tomorrow…

Read More