The International Accounting Standards Board (IASB) has published its new standard IFRS 18 ‘Presentation and Disclosures in Financial Statements’ that will replace IAS 1 ‘Presentation of Financial Statements. The new IFRS responds to investors demand for better information about companies financial performance and to improves transparency in the financial statements that will give the investors a better basis for analyzing and comparing companies’ performance.

IFRS 18 was issued in April 2024 and applies to an annual reporting period beginning on or after 1 January 2027.

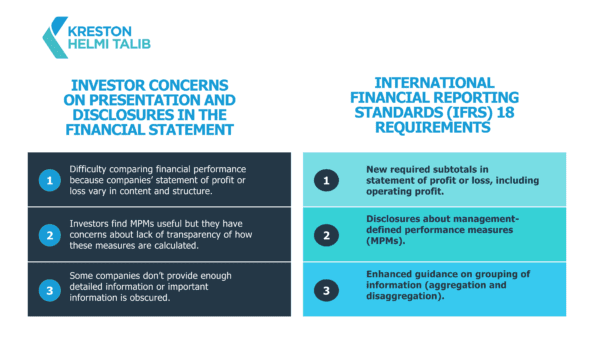

In response to investor concerns, the international financial reporting standards (IFRS) 18 have outlined three updates as below:

- New required subtotals in statement of profit or loss, including operating profit

Classification of Income and Expenses:

- All income and expenses must be included in the statement of profit or loss, unless otherwise specified by IFRS.

- These items are classified into five categories: operating, investing, financing, income taxes, and discontinued operations.

Operating, Investing, and Financing Categories:

- Main business activity determines the classification of income and expenses.

- Operating category includes income and expenses from core operations, volatile and unusual income and expenses excluding those related to investing or financing activities.

- Investing category typically includes income and expenses from investments, cash equivalents, and other assets generating independent returns (i.e rental income and remeasurements of investment property, interest income and fair value changes on financial assets, dividends and fair value changes on non-consolidated equity investments)

- Financing category typically includes income and expenses from liabilities arising from raising finance, interest, and changes in interest rates.

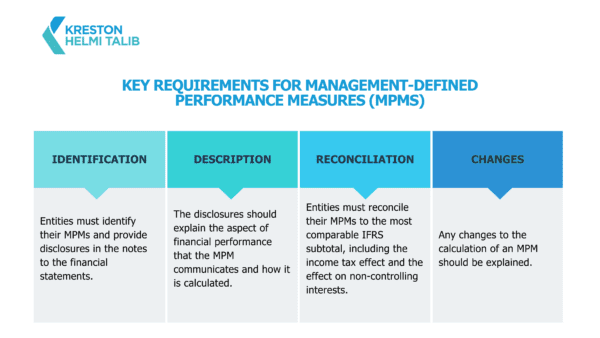

2. Disclosures about management-defined performance measures (MPMs)

IFRS 18 requires entities to disclose information about management-defined performance measures (MPMs). These are alternative performance measures that management uses to assess the entity’s financial performance.

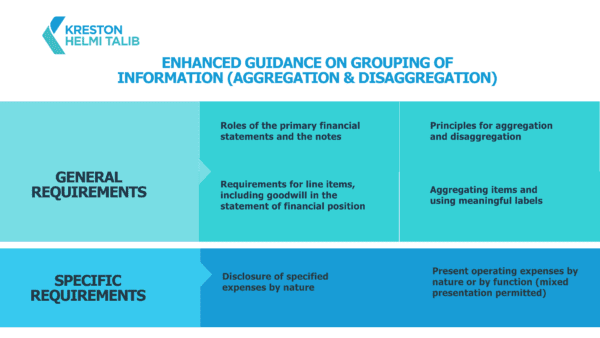

3. Enhanced guidance on grouping of information (aggregation and disaggregation)

IFRS 18 outlines specific criteria for combining or separating information based on common attributes.

Even though IAS 1 will be replaced by IFRS 18, certain general requirements from IAS 1 will remain in effect.

Sample requirements carried forward from IAS 1:

- Presentation requirements on statement of comprehensive income and statement of changes in equity

- Disclosures on :

- Material accounting policies

- Sources of estimation uncertainty

- Capital management

- Debt covenants

The implementation of IFRS 18 will have a significant impact on the way companies prepare and present their financial statements. By complying with these new requirements, companies can improve their credibility with investors and enhance their ability to attract capital.

________________________________________________________________________________________________________________________________

All materials have been prepared for general information purposes only. The information presented in this document is not legal advice, is not to be acted on as such, may not be current and is subject to change without notice. Professional advisory should be sought before taking or refraining from any action as a result of the contents of this document. Details are based on the information as of 01 January 2025.